Crypto-investors have been attentively monitoring the transition to a decentralized future since the launch of Bitcoin in 2009. Particularly in these unsteady economic times, cryptocurrencies continue to provide advantages over traditional currencies.

We've heard about everything: fraud, money laundering, scams, and dark markets. Even now, with much more knowledge about the underlying nature and possibilities of Bitcoin, the criticism persists.

The "big brother" nearly seems to be attempting to keep the coin's value low.

You might wonder why. Well, the majority of cryptocurrencies aim to return financial control to their consumers. This scares the banks. They decide to obstruct any technology that is incompatible with their business strategy rather than trying to adapt.

They speak quite loudly but also ineffectively. People who decide to conduct their own investigation quickly realize that the reasons put out in such unfavorable blogs are, at the very least, false.

As a result, we will discuss the advantages of cryptocurrencies in this post and dispel some of the myths surrounding them. Stay tuned to find out why cryptocurrency is far superior to what people think it is and how it is gradually altering the way that money functions.

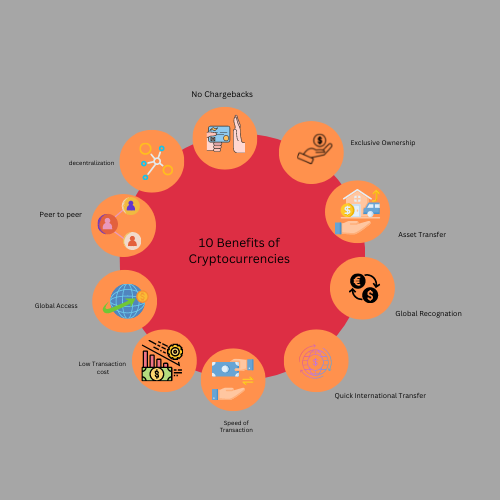

10 Benefits of Cryptocurrency

Since there are various uses for cryptocurrencies, not all of the advantages listed below may be applicable to all of them. But this explanation of the benefits of digital currency is a fantastic place to start.

Decentralization

When it comes to cryptocurrency, everyone talks about decentralization, but what exactly does the phrase mean?

In other words, when a service is decentralized, the people who use it gain control over it instead of the central organization that controls and distributes it.

Globally speaking, centralized economic systems are prevalent throughout the world. This indicates that the nation's citizens' funds are managed by a single central organization.

This strategy's biggest drawback is the requirement for faultless reliance on the very top, which is impractical. Any wrongdoing—intentional or not—will have a detrimental impact on the entire system.

Cryptocurrencies were created to address this issue of centralized power and improve the democracy and fault tolerance of financial systems.

Unrestricted Peer-to-Peer

Cryptocurrencies' peer-to-peer functioning is essential and results directly from their decentralized nature. It's one of the most significant advantages of cryptocurrencies since it restores anonymity and enables transactions between users without their consent.

This isn't precisely the situation right now. Here's a far too typical illustration:

You must visit a bank and request authorization to open and use an account if you wish to open a bank account.

This bank has the right to at any point make your money inaccessible and even permanently withdraw your access to them, citing whatever justifications they may deem sufficient. They might not even provide one.

Global Access

Inadequate financial services are unavailable to more than 2 billion people worldwide. They are unable to transmit or hold money in any other method than cash because of logistics, accessibility, or other reasons.

However, they do have access to the internet and cell phones.

The second advantage of cryptocurrencies is that you can trade with nothing more than a wallet and an internet connection.

The unbanked may establish and run their own bank using cryptocurrency, and they can control their funds from anywhere in the globe. Without going via a bank, they may receive, transmit, and save money using a bitcoin wallet of their choice.

An excellent illustration of that is developing nations. They are able to safely keep their value by avoiding unreliable financial services.

Low transaction costs

You may undoubtedly have to pay some fees while utilizing banking or digital wallet services.

Financial services are, after all, a profit-driven industry.

Transaction costs, which at first may appear little, may add up rapidly, especially if you make several transactions involving large amounts of money.

In contrast, there are seldom any transaction costs when utilizing cryptocurrency. You may choose the costs on your own and they are not related to the amount you are transferring, which might effect how quickly a transaction completes.

Speed of transactions

In the quick-paced society we live in, bank transfers, whether online or offline, are time-consuming and very inconvenient. You must either wait a few days or pay a high transaction charge if you need to use a bank facility to make a speedy payment.

Sincere to goodness, not all cryptocurrencies have the same transaction speeds. For instance, Bitcoin has frequently received criticism for having inadequate scalability when there are many users on the network.

Even said, "slow transactions" are still completed in a matter of minutes as opposed to the "1-5 business days" approach used by conventional banks.

However, because of their larger block sizes, cryptocurrencies like Litecoin (LTC) and Stellar (XLM) enable substantially speedier transactions. The adoption potential is increased for both consumers and businesses.

Quick international transfers

Have you ever sent money overseas? It's costly, time-consuming, and not really practical.

In addition, often moving huge sums of money might cause your banking service to warn you or perhaps temporarily block your funds.

On the other side, there are no localization restrictions or dollar limits when transmitting cryptocurrency. Without fearing that your money can be intercepted or that your transfer would be delayed for any reason, you can send money anywhere in the world.

In summary, the use of cryptocurrencies speeds up cross-border transactions and keeps costs to a minimum.

Recognition by All

If you travel frequently and conduct business internationally, you are frequently confronted by exchange rates and currency restrictions while attempting to complete a transaction.

It can even be difficult for you to swap your money.

That's not a problem with crypto. One advantage of cryptocurrencies is that, at a certain value, they are accepted everywhere in the world.

This can help you save time when figuring out the cost of a transaction and any additional costs associated with exchanging money with another person.

No matter where you are geographically, exchanging money gets simpler as cryptocurrencies are embraced on a broader scale.

Transfer of Assets

Brokers, bank transfers, percentage fees, and other legal stumbling blocks must be overcome when buying real estate or even a car. These all add to the final cost of the product you are buying and prolong the procedure well beyond what is necessary.

Cryptocurrencies, however, are more than simply virtual cash. Smart contracts are an idea put forth by several blockchains, including Ethereum, to facilitate risk-free and secure asset transactions.

Instead of taking days or weeks to safely transfer real estate via a broker, you can do it using cryptocurrency in a matter of minutes.

Exclusive Ownership

You own every single coin in your wallet, which is one of the main advantages of cryptocurrencies.

Financial services currently don't adhere to this approach. Every service that holds money for you seizes your money and forces you to follow its terms of service. They could restrict access to your funds and suspend your account if they determine that you broke these rules.

This is simply not doable with crypto. You have complete control over how you manage your funds thanks to its decentralized structure and peer-to-peer functionality. You are the only one who is dictating the rules here.

No chargebacks on irreversible transactions

Anyone who regularly uses digital payment platforms like PayPal is familiar with the agony of a payment dispute. Even credit card owners have the right to reject a transaction, often for a period of up to 60 days.

This is a significant issue for a business that is waiting to get paid. To properly claim the funds as their own, they must get through this waiting period. Additionally, chargeback disputes are a time-consuming procedure that, if unsuccessful, may do businesses great harm.

This issue is solved by blockchain technology and cryptocurrency. Instead of a "pull" transaction, in which the seller requests information from the buyer, a "push" transaction involves the buyer transferring money to the seller.

%20(1)%20(1)%20(1)%20(1)%20(1)%20(1).jpg)